Reprinted from GaryNorth.com

John Maynard Keynes was a crackpot. So are his followers. All of them.

I can hear the shocked response. “But, Dr. North, you’re not supposed to say such things. It’s not polite. It shows a lack of etiquette. People who say such things are themselves dismissed as crackpots.” To which I respond: “Dismissed by whom?”

Here is my view: “Crackpot is as crackpot does.”

Also: “Crackpot was as crackpot wrote.”

Here is a passage from Keynes’ General Theory of Employment, Interest, and Money (Macmillan, 1936). This book has remained in print in the original edition ever since.

You are about to enter into Keynes’ verbally garbled world. It was a mental world of sheer crackpottery. It was a world in which free lunches provided by the state were promised to be only one generation away. This passage appears on pages 220-21.

Let us assume that steps are taken to ensure that the rate of interest is consistent with the rate of investment which corresponds to full employment. Let us assume, further, that State action enters in as a balancing factor to provide that the growth of capital equipment shall be such as to approach saturation point at a rate which does not put a disproportionate burden on the standard of life of the present generation.On such assumptions I should guess that a properly run community equipped with modern technical resources, of which the population is not increasing rapidly, ought to be able to bring down the marginal efficiency of capital in equilibrium approximately to zero within a single generation; so that we should attain the conditions of a quasi-stationary community where change and progress would result only from (p. 220) changes in technique, taste, population and institutions, with the products of capital selling at a price proportioned to the labor, etc., embodied in them on just the same principles as govern the prices of consumption-goods into which capital-changes enter in an insignificant degree.

If I am right in supposing it to be comparatively easy to make capital-goods so abundant that the marginal efficiency of capital is zero, this may be the most sensible way of gradually getting rid of many of the objectionable features of capitalism. For a little reflection will show what enormous social changes would result from a gradual disappearance of a rate of return on accumulated wealth. A man would still be free to accumulate his earned income with a view to spending it at a later date. But his accumulation would not grow. He would simply be in the position of Pope’s father, who, when he retired from business, carried a chest of guineas with him to his villa at Twickenham and met his household expenses from it as required (p. 221).

This is sheer crackpottery. It is a theory of economics in which the State — capitalized by Keynes — has the power to deliver free lunches forever.

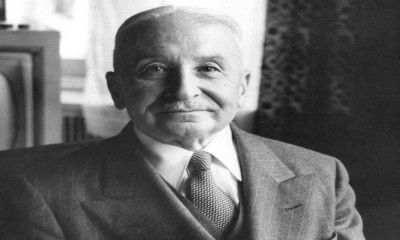

This is why Ludwig von Mises dismissed Keynes’ economics as a philosophy of stones into bread.

THE CRACKPOTS ARE IN CHARGE

Here is reality: all of the non-Keyenians economists who are allowed by the tenured Keynesians who hire and fire lower-ranked economists will not put up with such effrontery as mine. The non-Keynesian junior professors must toe the line. So, desperate young economists with their newly minted Ph.D. degrees and a mountain of student debt guard their tongues. They learned this technique in their first year of economics as undergraduates. “One does not call a spade a spade in a department run by spades.”

I spotted the name of this game at age 22, and I decided that I would not play it. I prefer to call a spade a spade. I majored in history in grad school, and did an end run around the crackpot economics guild. I did not become dependent on them for my living.

To keep bright young would-be economists from figuring out that they will spend their careers in the shadow of crackpots, professors do not assign The General Theory. This is deliberate. The crackpots in charge know that an early reading of this conceptual and verbal monstrosity might result in a response analogous to Toto’s in The Wizard of Oz. They would start looking for the little man behind the curtain. They might even lift their legs on him. That would be the appropriate response.

The initial response of these little men, whenever they are identified as adherents of a system based on a truly crackpot book, The General Theory, is to deny that Keynes said any such thing. But he did. Second, they assure us that Keynes really meant something else, despite the fact that what Keynes wrote, to the extent that it is marginally coherent, says what any reader who made it to page 220 understands: capital at zero price, interest at a zero rate. He meant exactly what he said, to the extent that anything in The General Theory can be described accurately as exact.

Keynes was a crackpot. That is why he wrote pages 220-21.

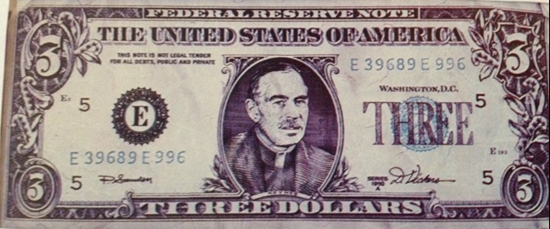

This is the economics of ZIRP.

It took longer than one generation to achieve it. It took a little over 70 years.

It took central bank counterfeiting.

SOMETHING FOR NOTHING

If the State is in charge, Keynes said, the price of capital will fall to zero in one generation.

Yet the value of the output of capital commands a price. People impute value to this output. They compete for ownership. Scarcity still reigns: “At zero price, there is greater demand than supply.”

How is it that something scarce — a consumer good — commands a price, but that which produced it — capital — is free?

This is a central conundrum of Keynesian economics. There is no logical answer to the obvious question. That is why Keynes was a crackpot, and all of his disciples are crackpots.

Until you come to grips with this fact, namely, that the economics profession, central bankers, and hedge fund analysts are crackpots, you will not understand the modern economic world.

When the marginal efficiency of anything is zero, it is a free good. It is not scarce. It commands no price.

If an asset that the government can get for nothing — capital — is essential to producing assets that command prices — consumption goods — then you would be wise to search for a sleight-of-hand operation. Unless you think that the state really is God, producing something out of nothing, then there is a trick. Either there really is magic available to the state’s planners or else there is prestidigitation. In short, someone in high places is deceiving the rubes.

I suggest the latter. That is because I am not a crackpot.

TIME PREFERENCE

Beginning with the writings of the Austrian economist, Eugen von Böhm-Bawerk, the universal phenomenon of the rate of interest has been explained by Austrian School economics in terms of what Mises called time preference: the discount applied by acting men to future goods and services when compared with the same goods and services in the present.

If you win the lottery tax-free, and you have a choice: cash the check today or in ten years, you will cash it today. The present money is worth more than the future money. You apply a discount to the future money. The rate of discount is the interest rate, or as Mises called it, the originary interest rate. We are not talking about the risk or loss, the risk of your death in a year, or the risk of price inflation.

Then how can it be that people will invest in government bonds that pay zero interest (ZIRP), or even more implausibly, charge a fee (NIRP)?

They are buying safety. They are buying the return of their money. It means that they are scared ZIRPless.

I don’t blame them. That is because I accept Mises’ theory of the business cycle. It is caused by prior central bank inflation.

Cautious investors prefer to own government bonds that pay nothing than to own corporate bonds of companies that may default. They also don’t want to own stocks.

They are paying for capital insurance. They think they will be able to get access to their money at some point by selling their government bonds.

Why not go down and withdraw currency? Because people with $100,000 to invest — or $100 million — cannot withdraw currency to match their digital wealth.

CONCLUSION

We now live in Keynes’ world of ZIRP. It will not be sustained. There will be corporate defaults, as feared. There will be massive losses in the stock market, as feared.

What goes around comes around. That which was crackpot economics in 1936 is still crackpot.

The crackpots who run the economics departments, the central banks, and the hedge funds have had their days of wine and roses. They have finally adopted the ZIRP economics of Keynes, where massive government deficits never end, and interest rates are zero.

But there comes a day when drunks must either sober up or die. They run out of money. There also comes a day when bartenders — buyers of government bonds — decide not to roll over the loans. They no longer listen when the drunk says, “Put it on my tab.”

But, for now, investors buy ZIRP bonds and NIRP bonds.

We do not live in Keynes’ prophesied neverland. We live in Keynes’ “you can trust the national government not to default” land.

The essence of Keynesianism is this: “So far, so good.” This is the confession of faith of a man who has leaped from a 30-storey building as he passes the 15th floor.

This is what we are dealing with:

Facebook

YouTube

RSS