Tax burdens are so high that it might not be possible to pay off the high levels of indebtedness in most of the Western world. At least, that is the conclusion of a new IMF paper from Carmen Reinhart and Kenneth Rogoff.

Reinhart and Rogoff gained recent fame for their book “This Time Is Different”, in which they argued that high levels of public debt have historically been associated with reduced growth opportunities.

As they now note, “The size of the problem suggests that restructurings will be needed, for example, in the periphery of Europe, far beyond anything discussed in public to this point.” Up to this point in the Eurocrisis the primary tools used to rescue profligate countries have included increased taxes, EU and IMF bailouts, and haircuts on government debt.

These bailouts have largely exacerbated the debt problems that existed five short years ago. Indeed, as Reinhart and Rogoff well note, the once fiscally sound North of Europe is now increasingly unable to continue shouldering the debts of its Southern neighbours.

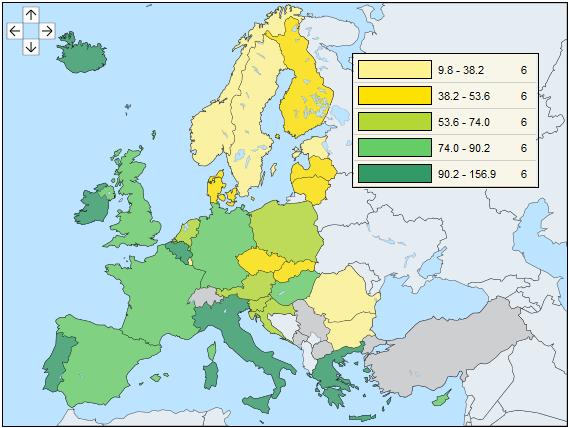

Six European countries currently have a government debt to GDP ratio – a metric popularlised by Reinhart and Rogoff to signal reduced growth prospects – of over 90%. Countries that were relatively debt-free just five short years ago are now encumbered by the debt repayments necessitated by bailouts. Ireland is a case in point – as recently as 2007 its government debt to GDP ratio was below 25%. Six years later that figure stands north of 120%! “Fiscally secure” Scandinavia should keep in mind that fortunes can change quickly, as happened to the luck of the Irish.

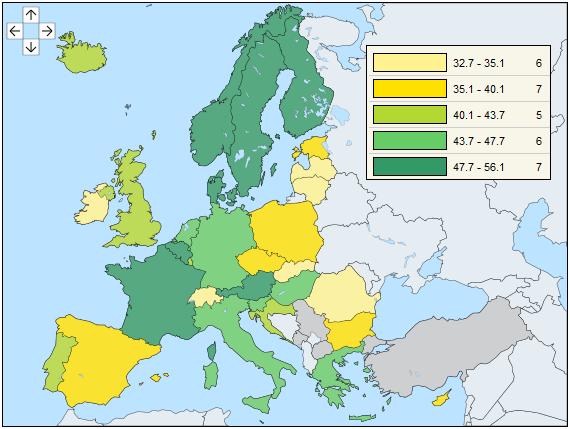

The debt crisis to date has been mitigated in large part by tax increases and transfers from the wealthy “core” of Europe to the periphery. The problem with tax increases is that they cannot continue unabated.

Already in Europe there are seven countries where tax revenues are greater than 48% of GDP. There once was a time when only Scandinavia was chided for its high tax regimes and large public sectors. Today both Austria and France have more than half of their economies involved in the public sector and financed through taxes. (Note also that as they both run government budget deficits the actual size of their governments is greater yet.)

With high unemployment in Europe (and especially in its periphery), governments cannot raise much revenue by raising taxes – who would pay it? With already high levels of debt it is questionable how much revenue can be raised by further debt issuances, at least without increasing interest rates and imperiling already fragile government finances with higher interest charges.

Instead, Reinhart and Rogoff see two facts of life for Europe’s future: financial repression through higher inflation rates and taxes levied on savings and wealth. This time is no different than other cases of highly indebted countries in Europe’s history – just look to the post-War examples as similar cases in point. Don’t say you haven’t been warned.

Cross posted at mises.org.

Facebook

YouTube

RSS