All posts tagged "banking"

-

Murray N. Rothbard October 22, 2015

-

Murray N. Rothbard October 21, 2015

-

ArticlesMenger Explains the Origins of Money

Foreword by Doug French (reprinted from Mises.org) The public’s understanding of what money is and its origins...

Doug French October 8, 2015 -

ArticlesThe Velocity of Circulation

From Money, the Market, and the State, edited by Nicholas B. Beales and L. Aubrey Drewry, Jr.,...

Henry Hazlitt October 7, 2015 -

ArticlesMises’s Contribution to Understanding Business Cycles

September 29, 2014 is the 133rd anniversary of Ludwig von Mises’s birth. From The Essential von Mises....

Murray N. Rothbard October 6, 2015 -

ArticlesHow Do We Get Rid of the Fed?

Reprinted from the Freeman When, if ever, will there be reform of the money system? Smart people...

Jeffrey Tucker October 5, 2015 -

Articles3 Stock Market Tips from an Economist

Reprinted from the Freeman Recent volatility has Americans talking about the stock market — and getting a...

Robert P. Murphy September 25, 2015 -

BlogFree banking vs the real bills doctrine

The problem with the “real bills” doctrine Re: Free banking vs.the real bills doctrine I wrote the letter below to Don Boudreaux of Cafe Hayek. Under the real bills doctrine banks would be allowed to create demand deposits backed by promissory notes and not reserves. Those who adhere to this doctrine, such...

Patrick Barron September 21, 2015 -

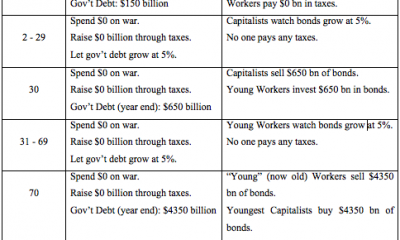

ArticlesGovernment Debt and Future Generations

Reprinted from EconLib.org Critics of government budget deficits often argue that deficits are irresponsible and cowardly because...

Robert P. Murphy September 11, 2015 -

ArticlesConfusions About Interest Rates Part 2

Following the 2001 dot-com crisis, interest rates were lowered to 1% and then slowly raised to 5%...

Frank Hollenbeck September 10, 2015 -

ArticlesConfusion About Interest Rates Part 1

Since 2008, central banks have rushed to lower interest rates to spur growth. This has induced mal-investments...

Frank Hollenbeck September 9, 2015 -

BlogThe Telegraph condemns QE (sort of)

The Telegraph last week printed a very muddled article by Jeremy Warner entitled “Jeremy Corbyn’s plan to turn Britain into Zimbabwe” that unintentionally made the case against the quantitative easing that is destroying market economies around the globe. Corbyn, who is running for the leadership of the Labour Party, has advocated a...

Bryce McBride September 2, 2015 -

BlogMy letter to the Financial Times, London re: The FT sides with counterfeiters and confiscators

Re: The case for retiring another barbarous relic Dear Sirs: I was appalled at your supposed “case” for eliminating cash, which you yourselves describe as the peoples’ “go-to safe asset”. And what IS your case? One, “cash…limits the central banks’ ability to stimulate a depressed economy.” Really? Although I am not in...

Patrick Barron August 28, 2015 -

ArticlesThe Slow-Motion Financial Suicide of the Roman Empire

Reprinted from the Freeman More than 2,000 years before America’s bailouts and entitlement programs, the ancient Romans...

Lawrence Reed August 26, 2015 -

ArticlesHow the 1% Provides the Standard of Living of the 99%

This essay originally appeared on Dr. Reisman’s blog on October 19, 2011, under the title “How a...

George Reisman August 24, 2015 -

F.A. Hayek August 21, 2015

-

F.A. Hayek August 20, 2015

-

BlogAre Austrian Criticisms of Mainstream Economics Still Relevant?

Occasionally, when Austrians try to distinguish their brand of doing economics from the mainstream, they get hit...

Ash Navabi August 3, 2015 -

ArticlesCentral Banks and Our Dysfunctional Gold Markets

Reprinted from Mises.org Many investors still view gold as a safe-haven investment, but there remains much confusion...

Marcia Christoff-Kurapovna July 31, 2015 -

ArticlesShort Memories in Las Vegas

Reprinted from LewRockwell.com Rates are low, the weather is hot, and builders are more active than they’ve been in years. “Groundbreakings on new homes surged 26.6% and permits to build new homes rose 30% in June compared to one year ago, the U.S. Commerce Department said Friday,”reports Forbes. Housing construction hasn’t seen...

Doug French July 30, 2015

-

Halloween and Its Candy EconomyArticlesOctober 31, 2016

-

The Central Role of Saving and Capital GoodsArticlesNovember 1, 2016

-

Salute to Von Mises: For 92 Years He Has Fought the Good FightArticlesNovember 2, 2016

-

Engineers and PlannersArticlesNovember 4, 2016

-

2016 International Conference of Prices & MarketsArticlesSeptember 8, 2016

-

Trump to pick ex-bank CEO who wants to abolish the Federal Reserve?BlogNovember 29, 2016

-

Gold Price Skyrockets in India after Currency Ban – Part IIArticlesNovember 29, 2016

-

Gold Price Skyrockets in India after Currency BanArticlesNovember 28, 2016

-

The Hidden Costs of ImmigrationBlogNovember 26, 2016

-

Gold Price Skyrockets in India after Currency Ban - Biblical Truths and Economics says:

[…] Part II: https://www.mises.ca/gold-price-skyrockets-in-india-after-currency-ban-part-ii/ […]

-

-

-

Upcoming Events

- No events

Articles

-

Gold Price Skyrockets in India after Currency Ban – Part IIArticlesNovember 29, 2016

-

Gold Price Skyrockets in India after Currency BanArticlesNovember 28, 2016

-

Boycott Black Friday?ArticlesNovember 25, 2016

-

Property and the First ThanksgivingArticlesNovember 24, 2016

Blog

-

Trump to pick ex-bank CEO who wants to abolish the Federal Reserve?BlogNovember 29, 2016

-

The Hidden Costs of ImmigrationBlogNovember 26, 2016

-

How to ArgueBlogNovember 23, 2016

-

Steve Bannon on bank bailoutsBlogNovember 16, 2016

Emerging Scholars

-

Praxeology in Many DisciplinesEmerging ScholarsMarch 3, 2015

-

Property Rights as Social Justice Part IIIEmerging ScholarsFebruary 3, 2015

-

“Left-Over” Women and Gender Inequality in ChinaEmerging ScholarsFebruary 3, 2015

-

China’s Unsustainable GrowthEmerging ScholarsJanuary 23, 2015

Who’s Active

-

active 1 day, 3 hours ago

-

active 1 day, 13 hours ago

-

active 2 days, 12 hours ago

-

active 4 days, 11 hours ago

-

active 6 days, 9 hours ago

Facebook

YouTube

RSS