Transcript of remarks before the Conference on the Economics of Mobilization, held at White Sulphur Springs, West Virginia, April 6-8, 1951, under the sponsorship of the University of Chicago Law School. Reprinted from The Commercial and Financial Chronicle, April 26, 1951.

Transcript of remarks before the Conference on the Economics of Mobilization, held at White Sulphur Springs, West Virginia, April 6-8, 1951, under the sponsorship of the University of Chicago Law School. Reprinted from The Commercial and Financial Chronicle, April 26, 1951.

In dealing with problems concerned with the economics of mobilization, it is first of all necessary to realize that fiscal policies have reached a turning point.

In recent decades all nations have looked upon the income and the wealth of the more prosperous citizens as an inexhaustible reserve which could be freely tapped. Whenever there was need for additional funds, one tried to collect them by raising the taxes to be paid by the upper-income brackets. There seemed to be enough money for any suggested expenditure because there seemed to be no harm in “soaking the rich” a bit more. As the votes of these rich do not count much in elections, the members of the legislative bodies were always ready to increase public spending at their expense. There is a French dictum: Les affaires, c’est l’argent des autres. “Business is other people’s money.” In these last 60 years political and fiscal affairs were virtually “other people’s money.” Let the rich pay, was the slogan.

End of an Era

Now this period of fiscal history has come to an end. With the exception of the United States and some of the British Dominions, what has been called the ability-to-pay of the wealthy citizens has been completely absorbed by taxes. No further funds of any significance can be collected from them. Henceforth all government spending will have to be financed by taxing the masses.

The European nations concerned are not yet fully aware of this fact because they have found a substitute. They are getting Marshall Plan aid; the U. S. taxpayer fills the gap.

In this country things have not yet gone as far as they have in other countries. It is still possible to raise an additional $2 or $3 billion, or perhaps even $4 billion, by increasing corporation taxes, and “excess profits” taxes, and by rendering the personal income tax more progressive. But under present conditions, even $4 billion would be only a fraction of what the Treasury needs. Thus, in this country we are also at the end of a period of fiscal policies. The whole philosophy of public finance must undergo a revision. In considering the pros and cons of a suggested expenditure the members of Congress will no longer be able to think: The rich have enough; let them pay. In the future, the voters on whose ballots the Congressmen depend will have to pay.

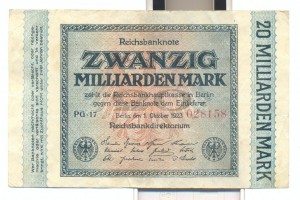

Inflation, an increase in money and credit, is certainly not a means to avoid or to postpone for more than a short time the need to resort to taxes levied on people other than those belonging to the rich minority. If, for the sake of argument, we leave aside all the objections which may be raised against any inflationary policy, we must take into account the fact that inflation can never be more than a temporary makeshift. Inflation cannot be continued over a long period of time without defeating its fiscal purpose and ending in a complete debacle as was the case in this country with the Continental currency, in France with the mandats territoriaux and in Germany with the mark in 1923.

What makes it possible for a government to increase its funds by inflation is the ignorance of the public. The people must ignore the fact that the government has chosen inflation as a fiscal system and plans to go on with inflation endlessly. It must ascribe the general rise in prices to other causes than to the policy of the government and must assume that prices will drop again in a not-too-distant future. If this opinion fades away, inflation comes to a catastrophic breakdown.

The Housewife’s Behavior

If the housewife who needs a new frying pan reasons: “Now prices are too high; I will postpone the purchase until they drop again,” inflation can still fulfill its fiscal purpose. As long as people share this view, they increase their cash holdings and bank balances, and a part of the newly created money is absorbed by these additional cash holdings and bank balances; prices on the market do not rise in proportion to the inflation.

But then?sooner or later?comes a turning point. The housewife discovers that the government expects to go on inflating and that consequently prices will continue to rise more and more. Then she reasons: “I do not need a new frying pan today; I shall only need one next year. But I had better buy it now because next year the price will be much higher.” If this insight spreads, inflation is done for, Then all people rush to buy. Everybody is anxious to reduce his holding of cash because he does not want to be hurt by the drop in the monetary unit’s purchasing power. The phenomenon then appears which, in Europe was called the “flight into real values.” People rush to exchange their depreciating paper money for something tangible, something real. The knell sounds of the currency system involved.

In this country we have not yet reached this second and final stage of every protracted inflation. But if the authorities do not very soon abandon any further attempt to increase the amount of money in circulation and to expand credit, we shall one day come to the same unpleasant result. It is not a matter of choosing between financing the increased government expenditure by collecting taxes and borrowing from the public on the one hand and financing it by inflation on the other hand. Inflation can never be an instrument of fiscal policy over a long period of time. Continued inflation inevitably leads to catastrophe.

Therefore, we should not waste our time in discussing methods of price control. Price control cannot prevent the rise in prices if inflation is going on. Even capital punishment could not make price control work in the days of Emperor Diocletian or during the French Revolution. Let us concentrate our efforts on the problem of how to avoid inflation, not upon useless schemes of how to conceal its inexorable consequences.

Taxation the Key

What is needed in wartime is to divert production and consumption from peacetime channels toward military goals. In order to achieve this, it is necessary for the government to tax the citizens, to take away from them the money, which they would otherwise spend for things they must no longer buy and consume, so the government can spend it for the conduct of the war.

At the breakfast table of every citizen in wartime sits an invisible guest, as it were, a GI who shares his meal. Parked in the citizen’s garage is not only the family car, but also?invisibly?a tank or a plane. The important fact is that a GI needs more in food, clothing, and other things than he used to consume as a civilian. And military equipment wears out much more quickly than civilian equipment. The costs of a modern war are enormous.

The adequate method of providing the funds the government needs for war is, of course, taxation. Part of the funds may also be provided by borrowing from the public, the citizens. But if the Treasury increases the amount of money in circulation or borrows from the commercial banks, it inflates. Inflation can do the job for a limited time. But it is the most expensive method of financing a war; it is socially disruptive and should be avoided.

Inflation: A Convenient Makeshift

There is no need to dwell upon the disastrous consequences of inflation. All people agree in this regard. But inflation is a very convenient makeshift for those in power. It is a handy means to divert the resentment of the people from the government. In the eyes of the masses, big business, the “profiteers,” the merchants,?not the Administration?appear responsible for the rise in prices and the ensuing need to restrict consumption.

Perhaps somebody will consider what I am saying here as anti-democratic, reactionary, and economic royalism. But the truth is that inflation is a typically anti-democratic measure. It is a policy of governments that do not have the courage to tell the people honestly what the real costs of their conduct of affairs are.

A truly democratic government would have to tell the voters openly that they must pay higher taxes because expenses have risen considerably. But it is much more agreeable for a government to present only a part of the bill to the people and to resort to inflation for the rest of its expenditures. What a triumph if they can say: Everybody’s income is rising, everybody has now more money in his pocket, business is booming.

Deficit spending is not a new invention. During the greater part of the 19th century it was the preferred fiscal method of precisely those governments that were not then considered democratic and progressive?Austria, Italy, and Russia. Austria’s budget showed a deficit yearly from 1781 on, until the late ’80s of the 19th century, when an orthodox professor of economics, Dunajewski, as Minister of Finance, restored the budgetary equilibrium. There is no reason to be proud of deficit spending, nor to call it progress.

Going After Lower Brackets

If one wants to collect more taxes, it will be necessary to lay a burden greater than hitherto on the lower income brackets, the strata of society whose members consume the much greater part of the total amount consumed in this country. Up to now it has been customary to tax predominantly corporations and individuals with higher incomes. But even the outright confiscation of these revenues would only cover a fraction of the additional funds the country needs today.

Some experts have declared that it is necessary to tax the people until it hurts. I disagree with these sadists. The purpose of taxation is not to hurt, but to raise the money the country needs to rearm and to fight in Korea. It is a sad fact that world affairs now make it necessary for the government to force people who used to buy nylon stockings and shirts to shift to other du Pont products, namely munitions.

In his book on Eternal Peace, the German philosopher Immanuel Kant (1724-1804) suggested that government should be forbidden to finance wars by borrowing. He expected that the warlike spirit would dwindle if all countries had to pay cash for their wars. However, no serious objection can be raised against borrowing from the public, from people who have saved and are prepared to invest in government bonds. But borrowing from the commercial banks is tantamount to printing additional bank notes and expanding the amount of deposits subject to check. That is inflation.

Semantic Confusion

There is nowadays a very reprehensible, even dangerous, semantic confusion that makes it extremely difficult for the non-expert to grasp the true state of affairs. Inflation, as this term was always used everywhere and especially in this country, means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check. But people today use the term “inflation” to refer to the phenomenon that is an inevitable consequence of inflation, that is the tendency of all prices and wage rates to rise. The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages. There is no longer any word available to signify the phenomenon that has been, up to now, called inflation. It follows that nobody cares about inflation in the traditional sense of the term. As you cannot talk about something that has no name, you cannot fight it. Those who pretend to fight inflation are in fact only fighting what is the inevitable consequence of inflation, rising prices. Their ventures are doomed to failure because they do not attack the root of the evil. They try to keep prices low while firmly committed to a policy of increasing the quantity of money that must necessarily make them soar. As long as this technological confusion is not entirely wiped out, there cannot be any question of stopping inflation.

Look at the silly term, “inflationary pressures.” There is no such thing as an “inflationary pressure.” There is inflation or there is the absence of inflation. If there is no increase in the quantity of money and if there is no credit expansion, the average height of prices and wages will by and large remain unchanged. But if the quantity of money and credit is increased, prices and wages must rise, whatever the government may decree. If there is no inflation, price control is superfluous. If there is inflation, price control is a sham, a hopeless venture.

It is the government that makes our inflation. The policy of the Treasury, and nothing else.

We have been told a lot about the need for, and the virtues of, direct controls.

We have learned that they preserve the individual’s liberty to choose the grocer he prefers. I do not want to examine what value may be attached to direct controls from a metaphysical point of view. I only want to stress one fact: As a means for preventing and fighting inflation or its consequences, direct controls are absolutely useless.

I think other site proprietors should take this website as an model, very clean and excellent user genial style and design, as well as the content. You’re an expert in this topic!

It by no means ceases in order to astonish myself that, using a bit of extra browsing on the internet, you can stumble on probably the most unique weblogs.

Great post. I just stumbled upon your blog and wanted to say that I have really enjoyed browsing your blog posts. In any case I’ll be subscribing to your feed and I hope you write again soon!

Many thanks for being my personal tutor on this issue. I enjoyed your article quite definitely and most of all favored the way in which you handled the aspect I regarded as being controversial. You are always very kind to readers really like me and let me in my life. Thank you.

Congratulations on possessing certainly one among one of the refined blogs Ive arrive across in a while! Its simply amazing how a lot you’ll be able to take into account away from a factor mainly simply due to how visually stunning it is. Youve place collectively an incredible weblog website area –great graphics, movies, layout. This is definitely a should-see web site!

I am always browsing online for posts that can assist me. Thanks!

I have to confess that i generally get bored to learn the whole thing but i feel you can add some value. Bravo !

Hi, how are you? because I absolutely enjoy your fine blog, I wuold feel special if you allow me to write a adorable review about your awesome website on my little Apple iPod Website would you grant me permission to? Yours, how can i grow taller

I recently came across an individual’s web log online and therefore test several of early threads. Manage in the very good perform. Freezing supplementary increase your RSS feed to assist you to my Bing Media reports Readers. Wanting forward to examining added from your website at a later time!…

Your house is valueble in my opinion. Thanks!…

I am glad for writing to make you be aware of what a fantastic discovery my cousin’s princess obtained going through your webblog. She came to find plenty of pieces, including how it is like to have a marvelous helping nature to get certain people with no trouble fully understand selected complex subject areas. You really did more than my expected results. Thank you for distributing the practical, trustworthy, informative not to mention unique tips about this topic to Julie.

I will quite simply state you come up with a few great ideas and I will post a variety of creative ideas to add in soon.

Really Appreciate this blog post, is there any way I can receive an alert email when there is a new post?

Hello, i think that i saw you visited my website thus i came to “return the favor”.I am attempting to find things to enhance my web site!I suppose its ok to use a few of your ideas!!

Thank you, I’ve recently been looking for information about this topic for a while and yours is the best I have found out so far. However, what in regards to the conclusion? Are you positive in regards to the source?

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

I think this is one of the so much significant information for me. And i am happy studying your article. But wanna commentary on some basic issues, The web site style is great, the articles is actually great : D. Excellent job, cheers

Wow that was unusual. I just wrote an incredibly long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Anyhow, just wanted to say superb blog!

Hello! I could have sworn I’ve been to this website before but after checking through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!

I reckon something truly special in this internet site .

קודם כל סקירה חשובה , בניתם דירה חדשה כדאי לעשות לדירה שלכם עיצוב פנים העונה לטעם שלכם , כדאי לכם לקבוע פגישהבעלי מקצוע או עם מעצבי פנים בכל מקצועות , עיצוב הבית , תכנון בנייה , שולחנות שידות ועוד דברים נוספים.

I love this article. Thanks. I have a blog where I could link this article to. I’m looking for sites where muscle building tips are being discussed. I think its very helpful to people starting out. I remember what its like when I was new at this. I scour the web for articles. Now I go to places where I could find everything under one place. Thanks for this article.

I much prefer a place where I could take all muscle building information from one source. Don’t get me wrong, this article is great. I’m going to link this on my site and refer it to others.

קידום דפי אינטרנט עושים רק בחברת קידום אתרים מקצועית כמו חברת נט-סטייל . צרו עמנו קשר על מנת לרכוש שרות של קידום אתרים בגוגל בדרך הטובה ביותר.

This post appears to recieve a good ammount of visitors. How do you advertise it? It gives a nice individual twist on things. I guess having something authentic or substantial to say is the most important thing.

I’d be inclined to play ball with you here. Which is not something I typically do! I enjoy reading a post that will make people think. Also, thanks for allowing me to speak my mind!

Interesting post i totally agree with the comments above. Keep us posting !!

I came across your website, i think your blog is interesting, keep us posting.

I like your blog theme. What template did you use ??

I like your blog design. What template did you use ??

I represented strictly seeking this subject material awhile. After 6 all day much like uninterrupted Googleing, at long last I got it in your blog . I enquire whats exactly the dearth like Google regime the particular dont rank this sort of illuminating sites in peak of each lean . The exact the best web sites are full such as scraps.